Could dark patterns be influencing your investing decisions? An OSCOSC See Ontario Securities Commission.+ read full definition research report examined digital engagement practices and how these techniques are being used on investing platforms. It also looked at how regulators in Canada, the U.S., and the EU are responding.

On this page you’ll find

Introduction

Online investing platforms have become increasingly popular among retail investors. These platforms make it possible for you to buy and sell stocks using your mobile device or computer. There is fierce competition among these platforms to appeal to customers like you. They also want to maximize revenue and profit.

Many investing platforms are using new marketing, engagement, and design techniques to influence your behaviour as an investor. The use of these techniques has generated global regulatory concerns due their negative impact on your financial wellbeing as an investor, as well as privacy risks.

The OSC research report, Digital Engagement Practices: Dark Patterns in Retail Investing, looked at how these techniques are being used by investing platforms and how regulators in Canada, the U.S., and the EU are responding. It builds on findings from the OSC’s previous research , Digital Engagement Practices in Retail Investing: Gamification and Other Behavioural Techniques.

Read the OSC’s latest report

What are digital engagement practices?

Many digital engagement practices are used by investing platforms, including behavioural techniques, gamification, and design elements that intentionally or unintentionally increase engagement with retail investors using these platforms.

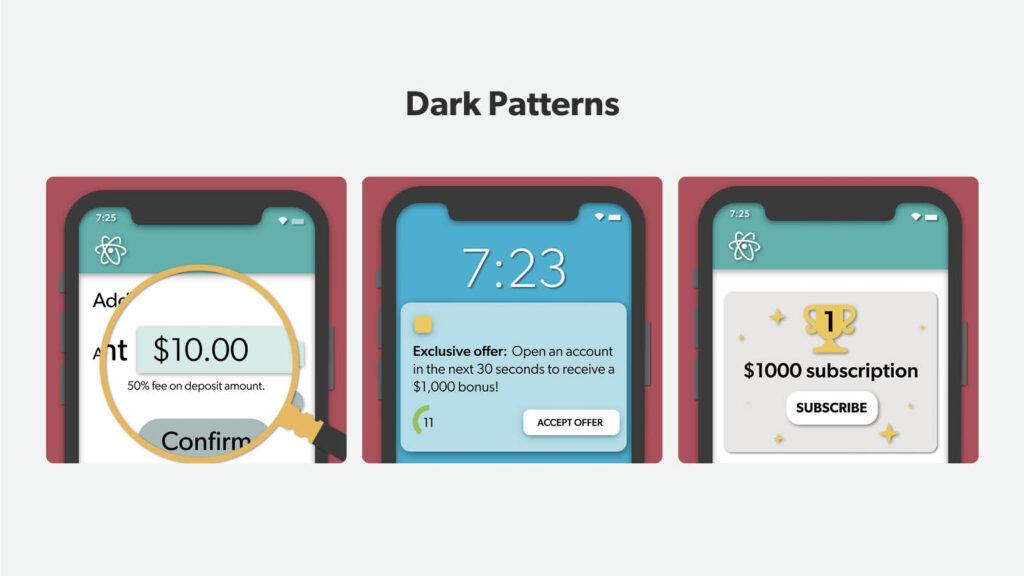

The OSC’s research found the use of dark patterns is prevalent on investing platforms, and this has been shown to negatively impact investor welfare. Dark patterns are a type of digital engagement practice that employ user interface choices to coerce, steer, and/or deceive users into making decisions that benefitBenefit Money, goods, or services that you get from your workplace or from a government program…+ read full definition a business but may not align with clients’ best interests.

Areas of particular concern include techniques that:

- Disguise the cost of investing (e.g., hidden fees and information).

- Obtain personal information without informed consent.

- Make it harder to withdraw funds or close an accountAccount An agreement you make with a financial institution to handle your money. You can set…+ read full definition.

The report also analyzed three other types of digital engagement practices that can harm investors:

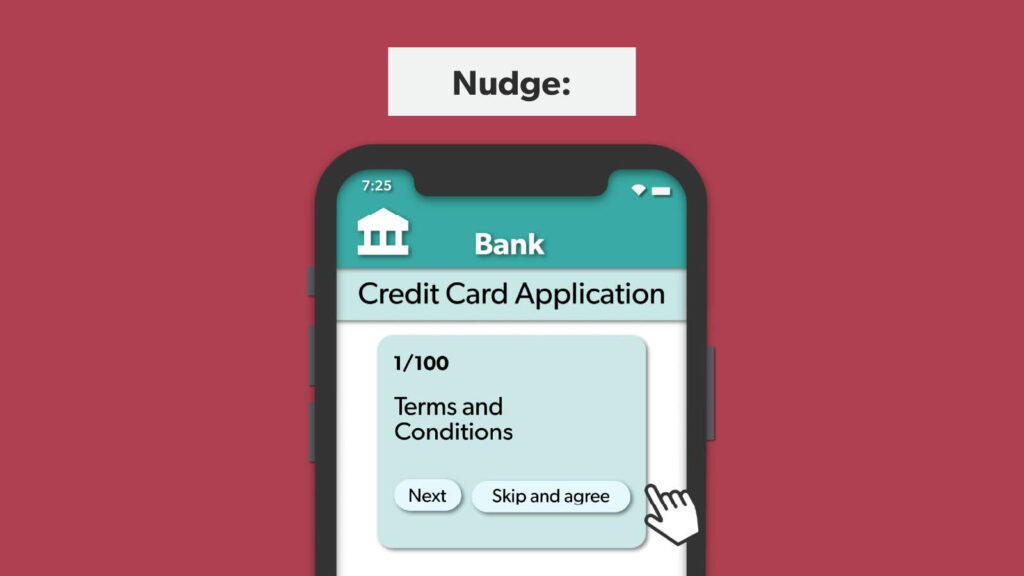

- Dark nudges – design elements that make it easier for users to make choices that do not align with their goals.

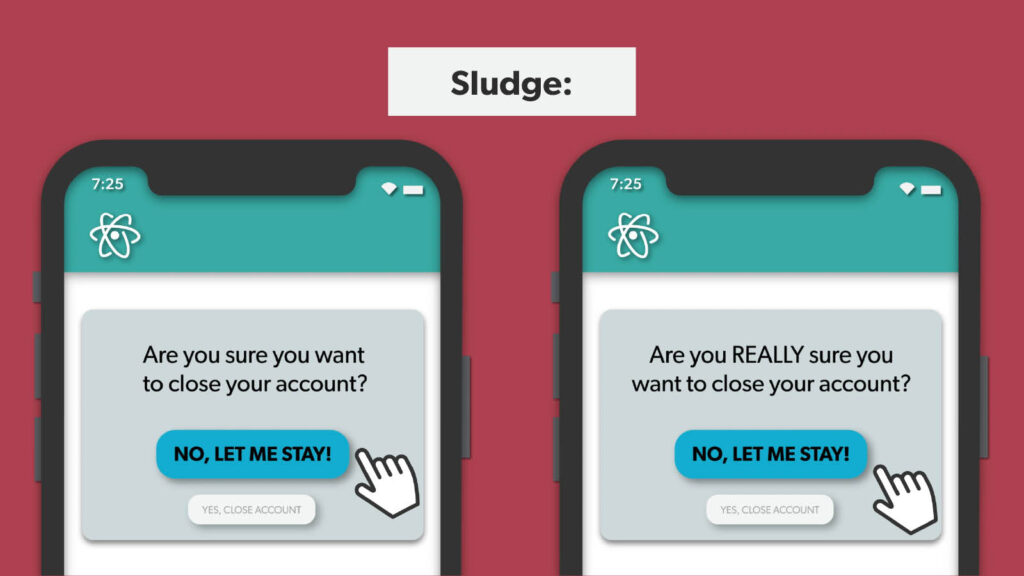

- Sludge – a design element within a user interface that makes it harder for users to make decisions that they want to make.

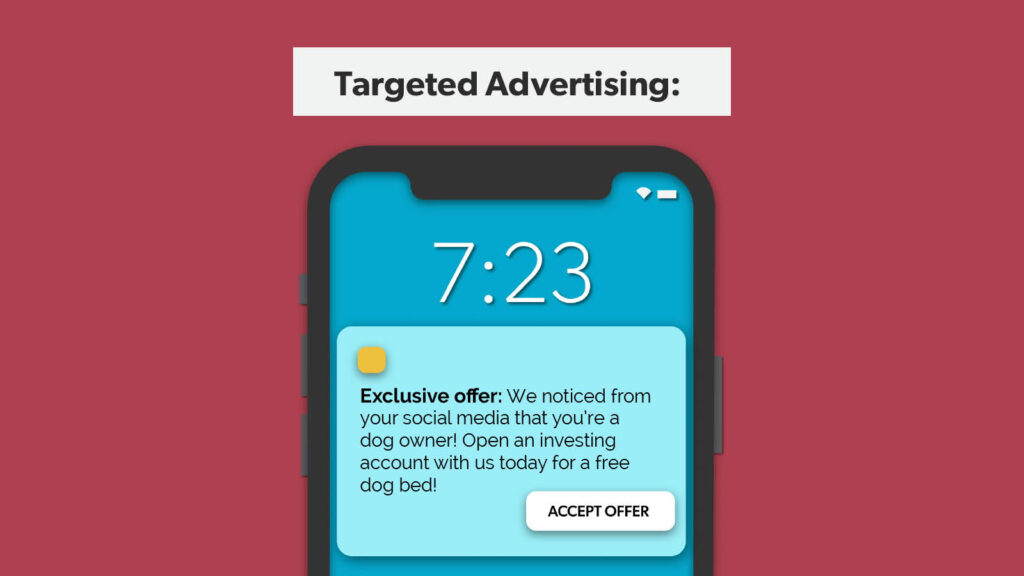

- Targeted advertising – uses data about people to specifically select and display ads or other forms of commercial content to them.

A key characteristic of dark patterns, dark nudges, sludge, and targeted advertising is that they undermine investor welfare. Some of the potential risks associated with these techniques include:

- Constraining users’ decisions by not providing the option to opt out of certain dark patterns or dark nudges, including certain prompts (e.g., price movement notifications) and ranked lists (e.g., platform-specific top-traded lists).

- Obtaining data without informed consent that is used for targeted advertising.

- Targeted advertising by investing platforms to vulnerable customers, people with cognitive limitations, and users likely to be new to or unfamiliar with online environments.

- Complex language within fee schedules and privacy protections, leading to a lack of understanding of these important components.

- The removal of process steps in executing trades, making it less likely that people will deliberate about a tradeTrade The process where one person or party buys an investment from another.+ read full definition before they execute it potentially leading to trades that are not in the best interest of the customer.

- Increased difficulty for customers to their close accounts and withdraw funds.

The report identified key situations where dark patterns and other techniques may lead you to engage in behaviours that are not in your best interest, including:

- Active trading: There is robust evidence that links increased trading volume with lower returns over time. This is due to both the timing of retail investor trades relative to other traders (e.g., institutional), as well as transactionTransaction The process where one person or party buys goods or services from another for money.…+ read full definition costs (e.g., commissionsCommissions What you pay to a broker or agent for their services. Often called a “sales…+ read full definition, trading fees).

- Under-diversificationDiversification A way of spreading investment risk by by choosing a mix of investments. The idea…+ read full definition: Diversification is the process of investing in multiple kinds of assets and securities over time to reduce overall risk. Under-diversification is costly to most investors, as it increases the risk of their portfolioPortfolio All the different investments that an individual or organization holds. May include stocks, bonds and…+ read full definition.

- Transaction costs: Transaction costs such as commissions, taxes, and fees reduce your returns. Transaction costs can be higher either through active trading or higher fees per trade.

- Risk profile of securities: In general, digital assets like crypto assets can be classified as higher risk investments, for many reasons including higher volatilityVolatility The rate at which the price of a security increases or decreases for a given…+ read full definition. OptionsOptions An investment that gives you the right to buy or sell it at a set…+ read full definition trading and trading on marginMargin A way to buy investments by borrowing money from a stockbroker. You must also invest…+ read full definition are also widely understood to be higher risk investmentInvestment An item of value you buy to get income or to grow in value.+ read full definition strategies.

Increased awareness of the use of digital engagement practices may help you to identify when your behaviour is being influenced.

What’s behind your investing decision making? Try our Behaviorial Bias Checker

How was the research conducted?

The research set out to answer the following key questions:

- How are dark patterns, dark nudges, sludge, and targeted advertising being used by investing platforms?

- How are these digital engagement practices influencing retail investor attitudes and behaviour, and how can any negative impacts be mitigated?

- How are Canadian, U.S. and other international regulators responding to these practices?

The Ontario Securities CommissionOntario Securities Commission An independent Crown corporation that is responsible for regulating the capital markets in Ontario. Its…+ read full definition (OSC) partnered with the Behavioural Insights Team (BIT) to conduct this research. A mixed-methods research approach was used to answer the questions above. It included the following key activities:

- Defining key terms – for dark patterns, dark nudges, sludge, and targeted advertising.

- Conducting a literature scan – to develop a taxonomy of the specific techniques that fit under each key termTerm The period of time that a contract covers. Also, the period of time that an…+ read full definition. This included a review of 37 sources, including peer-review publications and “gray” literature (i.e., non-peer-reviewed publications).

- Reviewing 10 investing platforms – to identify which techniques from the taxonomy are present on platforms and how they are used. The platforms included major online trading and investment services, including regulated and unregulated crypto trading firms. This review also revealed additional techniques that were not identified in the literature review.

Why are regulators concerned about dark patterns?

Online investing platforms can give you more ways to participate in the markets, but regulators are concerned that digital engagement practices threaten investor protection.

Improving the investor experience and expanding investor protection is a key OSC priority. Regulators, including the OSC, are monitoring the usage and impact of digital engagement practices in the investment industry and the influence (whether inadvertently or otherwise) these techniques may have on retail investors.

Increased awareness of the use of digital engagement practices among investors may help them to identify when their behaviour is being influenced. The findings from this research and the OSC’s previous research, Digital Engagement Practices in Retail Investing: Gamification and Other Behavioural Techniques, provide valuable insights and reinforce the benefit of using behavioural science as a policy tool by regulators.

Remember to always check before you invest.