Start here to begin your tour of Fund Facts or learn on your own by clicking the numbered arrows.

Fund Name

Some funds offer more than one series or class of securities. This information is indicated in the fund’s name. Different series/classes offer different features to help people meet different investment goals.

Fund manager

The manager, sometimes referred to as the investment fund manager, directs the business, operations and affairs of the fund.

Portfolio manager

The portfolio manager provides investment advice and portfolio management services to the fund.

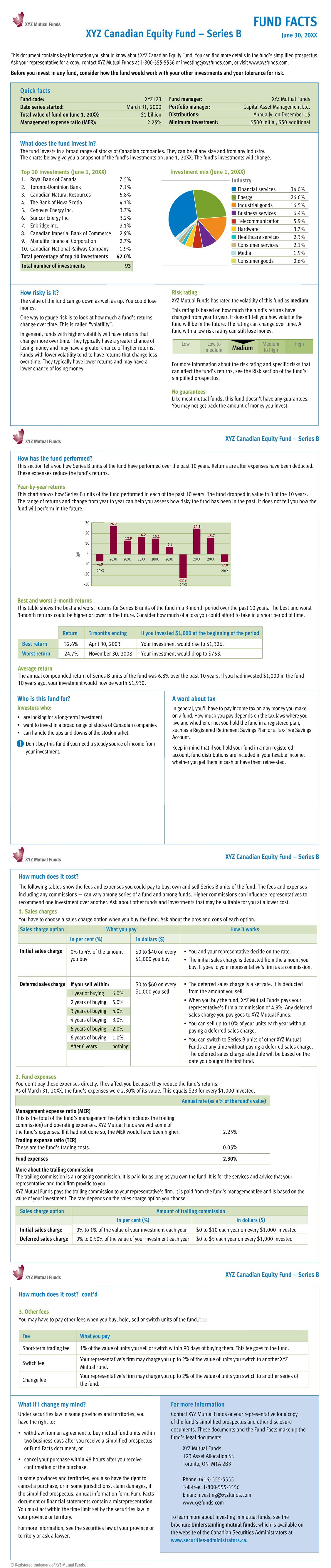

Top 10 investments (June 1, 20XX)

These are the fund’s 10 largest investments as of the date shown in Fund Facts. The percentage of net asset value of the fund is also shown for each top 10 investment. The total number of investments in the fund gives you a sense of how diversified the fund’s investments are.

Investment

mix (June 1, 20XX)

The investment mix provides a breakdown of the fund’s investment portfolio to give you a better idea of the fund’s investment exposure. Depending on the type of the fund, this breakdown can be by industry, asset class, geographic

location, etc.

How risky is it?

All investments have some risk. The risk rating is determined by the manager and is generally based on volatility. The fund’s risk is rated from low to high. Even a fund with a low risk rating can lose money. The rating can change over time. More information about the risk rating and specific risks that can affect the fund’s returns can be found in the fund’s prospectus.

Are there any guarantees?

Most mutual funds do not have any guarantees. You may not get back the amount of money you invested. Past performance may not be repeated. Even a fund with a low risk rating can lose money.

How has the fund performed?

This shows you how the fund has performed over the long term. The time period shown is up to 10 years, but if the fund is less than 10 years old, only the years available will be shown. The returns are net of expenses.

Year-by-year returns

This shows you how stable or how volatile fund returns have been from year to year. It can also show how the fund performs in difficult times, such as the period following the 2008 financial crisis.

Who is this fund for?

Are you trying to grow your money over the long term, or looking for a steady payout from this investment? Use this section to determine whether the fund fits your investment goals for growth and income. You should also consider how the fund fits in with the rest of your portfolio.

A word about tax

This section is standard in all Fund Facts. Depending on whether your investment is in a registered or non-registered account, it will be taxed differently. Learn more about how investments are taxed.

How much does it cost?

Fees and expenses reduce the fund’s return. In addition, higher commissions have the potential to influence representatives to recommend one investment over another. Learn more about mutual fund fees.

Trailing commission

The trailing commission is an ongoing charge for services and advice provided by your representative and their firm. Trailing commissions are paid out of the fund’s management fee. The manager pays this commission for as long as you hold the fund and the rate depends on your sales charge option. Higher trailing commissions can influence representatives to recommend one fund over another.

What if I change my mind?

You may decide, after you purchase the fund, that it is not right for you. You may have the right to cancel your order within a certain time period if you change your mind.

For more information

Fund Facts provides key information about a fund. This section tells you who to contact to get more detailed information which is available in the fund’s simplified prospectus.